See how you can potentially save and reduce repayments for your home loan. No commitments Home Loan health check and a FREE Refinance pack. – LIMITED TIME ONLY

Some of the brokers associated with us have access to 35 lenders across Australia.

You may find that trying to navigate the complexities of your home loan agreement and making heavy interest payments every month can be stressful. Talking to a Home Loan Specialist may simplify things and potentially free you some additional funds.

Our Mortgage Brokers can work with you so that you can get the best deal on your home loan with better interest rates.

Consolidate your debts by folding several debts in a single loan. This could improve your cash flow problems.

Refinancing your home loan allows you to reduce your monthly repayments for your loan and therefore boost your savings

Refinancing is not only about saving money but also allows you to allocate money towards your home for renovations.

Withdraw some funds for your dream vacation you have been planning for years. You may also get reduced interest rates.

These are the general reasons for refinancing and not taking your personal circumstances into the account. Please discuss your circumstances with the mortgage broker for financial solutions.

See how you can potentially save and reduce repayments for your home loan. No commitments Home Loan health check and a FREE Refinance pack. – LIMITED TIME ONLY

Jane is our fictitious character who likes to get a good deal, but it may seem that she has set and forgotten about it when it comes to home loans. The Australian Competition and consumer commission have reported that Australians like Jenny with home loans between 3 to 5 years old pay an average of 0.58% more than she needs to. Media Release ACCC

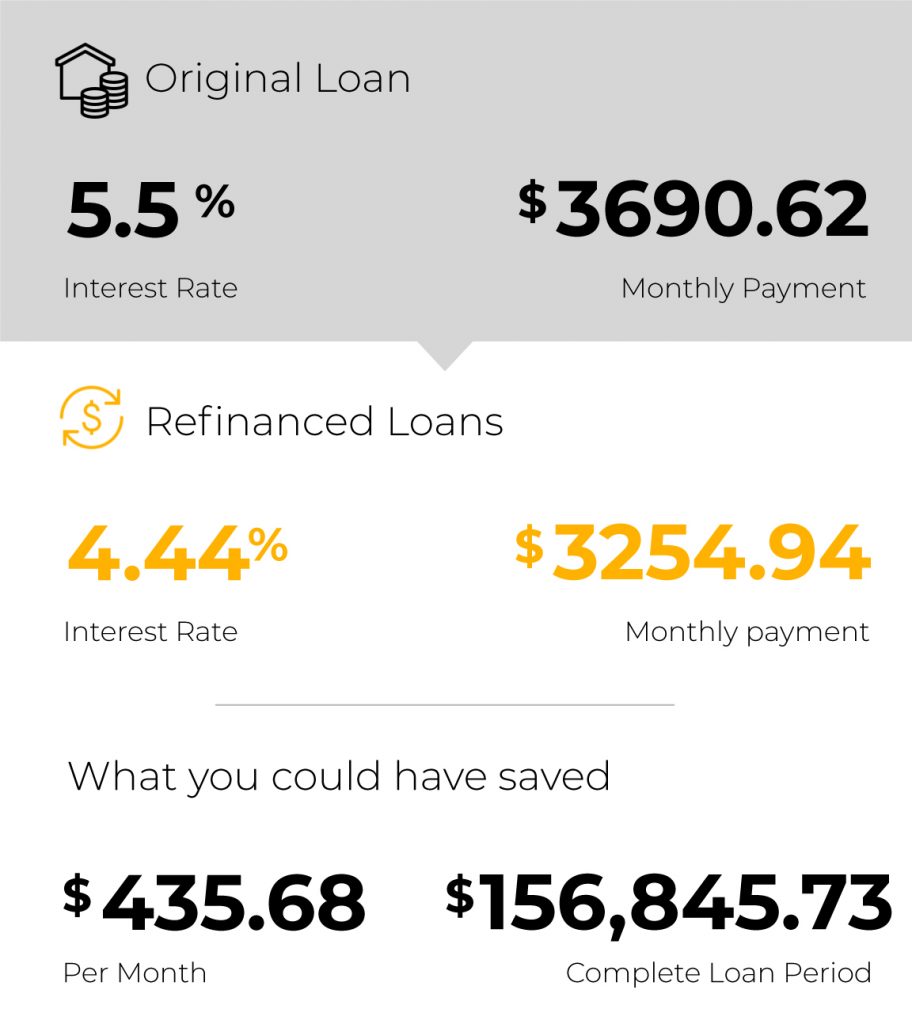

Let us imagine Jane has taken a home loan of $650,000 at a rate of 3.5%, and she is paying 0.58% more on the interest payments that she could avoid if she takes up the best available offer for her. She is currently paying $230.67 more a month than she has to on a 30-year loan. Taking up the best deal, Jane can save up to $156,845.73 on her 30-year home loan.

The world of finance and interest rates are constantly changing, which means you can potentially save a lot of money from it.

At Mortgage Room, we take you through 3 easy steps to help you refinance your home loan, and providing you with the financial space and freedom to pursue your other dreams.

Fill out a simple form and speak to one of our team members. We will be taking a few relevant details about your home loan so that partnered Home Loan Brokers can best serve you.

Our Mortgage Brokers are certified and regulated by the Financial Conduct Authority and provide you with a specialised and expert solution on home loan products.

Now that you have refinanced your home loan with our Mortgage Broker. Enjoy the new rate or better terms of finance. It's time to look forward to achieving your next big goal.

See how you can potentially save and reduce repayments for your home loan. No commitments Home Loan health check and a FREE Refinance pack. – LIMITED TIME ONLY

Reducing your monthly interest obligation may potentially free you to invest back into your life and goals

Our guide will give you general scenarios and information on how, a homeowner such as yourself, can pay off your home loan faster and improve savings on your monthly repayments with the power of refinancing.

Easy to fill and complete, use the – Home Loan Health check and talk to our mortgage broker. This could be your first step towards financial well being.

With tips and strategies providing you with general information on how to Pay Off your mortgage faster

It's important to check if your current home loan is still working for you or not. Our panel of mortgage brokers may be able to help you.

Refinance Language and Glossary helps you navigate the complex terms of your Home Loan and be on top of things.

At Mortgage Room, we connect you with our trusted and hardworking team of licensed Mortgage Brokers so that you may save hundreds of thousands of dollars over the life of your home/house loan and start investing back into your life. Our certified Broker’s are happy to work towards relieving the stress and pressure that comes with seeking, comparing, and applying for loans, with the objective of finally assisting you in obtaining the best possible home loan offer.

“Reduce your monthly repayment obligation and free yourself to invest back in to your life and goals.“

Our Services aim to making your life easier with excellent Home Loan services

Refinancing can help you get better interest rates on your home loan and make quicker repayments

Maintain a great work-life balance and get the best Home Loan offer you can from our lenders across Australia

Tap into your SMSF to gain access to fund that can help you buy the investment property of your choice

Do you have a low credit score and unable to get the best interest rate for your Home Loan?

Avoid paying the LMI when you are taking more than 80% of the Property Value as a loan, talk to use today

Get the best Home Loan you can with expert lenders who model the Home Loan around your needs

It is 100% free! We don't charge you anything as we work directly with the top brokers in the country and earn our fee from them.

The amount you will be saving can depend upon your current loan period, interest rate, and the number of years left on your loan.

You will be provided with an estimate after you start working with one of our Mortgage Broker.

At Mortgage room, we recognise that every application is different, and therefore each application is provided with a personal touch, and after an internal process, we match you with the best possible Mortgage Broker

Our internal process considers your situation and links you with the best possible mortgage broker on our panel.

In the case of poor credit, your application will be handled by experts who specialise in dealing with such matters. At Mortgage Room, we believe everyone deserves the home of their dreams.

We can deal with regular residential mortgages and more complex situations involving land, investment properties, buying on trust and Asset Protection. Some of our Mortgage brokers are also registered accounts.

So if you are looking to take equity from your home, consolidate some debt, lower monthly payments or want to secure unbeatable incentives, talk to our mortgage broker and see if they can help you.

At Mortgage Room, we recognise that the Covid-19 pandemic has affected many families and homeowners. Every homeowner should be able to access their savings by refinancing. Please discuss your situation with Mortgage Broker and see how he can assist you with the current situation.

See how you can potentially save and reduce repayments for your home loan. No commitments Home Loan health check and a FREE Refinance pack. – LIMITED TIME ONLY

We Are One of Australia’s Reliable and Trusted Home Loan Service Providers

info@smartmortgagefinance.com.au

16 Arnold Place, Glenwood NSW - 2768

+61 411-584-462

Credit Rep Number – 517750 | ABN – 30620735748

Website Developed by – Woo Media

Copyright © 2023. All rights reserved.